In the past 12 months, just 5% of Columbus rentals were listed for under $1,000 – down from 12.8% a year ago

In recent years, rising rental costs have pushed affordability further out of reach for many renters across the U.S., making finding a home for under $1,000 increasingly difficult. In fact, half of all renters now pay more than 30% of their income toward rent, underscoring the gap between market rates and wages.

This trend is especially obvious in Columbus, OH, where just 5% of rentals on the market are listed for under $1,000. The nationwide average is 7.5%. But just last year, Columbus was much more affordable.

So what’s happening in the rental market? Why does Columbus now have so few rentals for under $1,000 per month? Let’s dive in to find out.

In Columbus, 5% of apartments are listed for under $1,000

Columbus has a rapidly falling share of rental listings below $1,000 in the country, at just 5% – less than half of what the share was just last year. Columbus’ share of $1,000 rentals has dropped largely because of its rising median asking rent, which has risen nearly $500 since 2019, to $1,350. The nationwide median asking rent is $1,634.

Rising rents and a shrinking share of affordable rentals are largely due to a supply-and-demand imbalance; there simply aren’t enough apartments to meet the demand. Columbus is a booming metro and is expected to grow by over 700,000 people by 2050, many of whom will be renters. This strain is amplified as large tech companies, like Intel and Google, move into the area, bringing an influx of wealth and workers but also putting pressure on housing and infrastructure. To help meet some demand, the city is working to update zoning codes to speed up housing development.

This sharp dip in affordable rentals is troubling given a growing proportion of income insecure residents. When accounting for the entire Columbus renter population, nearly half are rent-burdened (spend more than 30% of their income on housing). Those living closest to the downtown core are the most rent-burdened, and Black renters are disproportionately impacted. Ohio has no rent control laws and few renter protections.

Rent-controlled and subsidized homes are an option, but Columbus faces a shortage of 52,700 affordable homes. The gap between wages and housing costs has also worsened in recent years.

What share of renters in Columbus actually pay less than $1,000/month?

Even though $1,000 listings are almost nonexistent, 40.4% of Columbus renters still pay less than $1,000 per month. This share is tied to the apartment unit and not an individual renter.

A higher share of Columbus residents pay less than $1,000 per month because many signed leases long ago when rents were much lower, or they live in subsidized (usually via Section 8) or public housing. Property owners do often raise rents for existing tenants, but those increases are typically smaller than the increases they institute when looking for a new tenant.

Unsurprisingly, the share of renters spending less than $1,000 on rent has dropped in the past decade, from 74.4% in 2012 to 40.4% today, underscoring how affordability in Columbus has worsened.

The share of $1,000 rentals has declined nationwide

Nationwide, 7.5% of listings on the market cost less than $1,000. This is a 0.1 percentage point (ppts) increase from the same time last year, but well below the 10% share in September 2019. Why are $1,000 rentals becoming less common?

The primary reason is because rents have increased dramatically. Rents skyrocketed during the pandemic because of a moving frenzy, housing boom, and lack of new construction. They reached a record high of $1,700 in August 2022, with some metros seeing $700 increases over only a few months.

Rents have since stopped rising and even declined in a few places over the past few months, but are still up nearly 21% from before the pandemic. This has massively strained lower-income renters.

How many renters nationwide pay less than $1,000/month?

Nationwide, 32.1% of renter households pay under $1,000 in monthly rent. This far outweighs the share of $1,000 listings, but is the lowest share on record. In comparison, 37% of renters paid less than $1,000 in 2022, and in 2012, the share was 50.4%.

This gap exists largely because many renters signed their leases years ago when housing was more affordable. Many of these renters are also staying put because they can’t afford the typical apartment on the market today. Property owners do often raise rents for existing tenants, but these increases are usually smaller than the increases they apply when seeking a new tenant.

Renters who are paying less than $1,000 a month are also more likely to have lived in their apartment for five years or longer.

Metro-level highlights

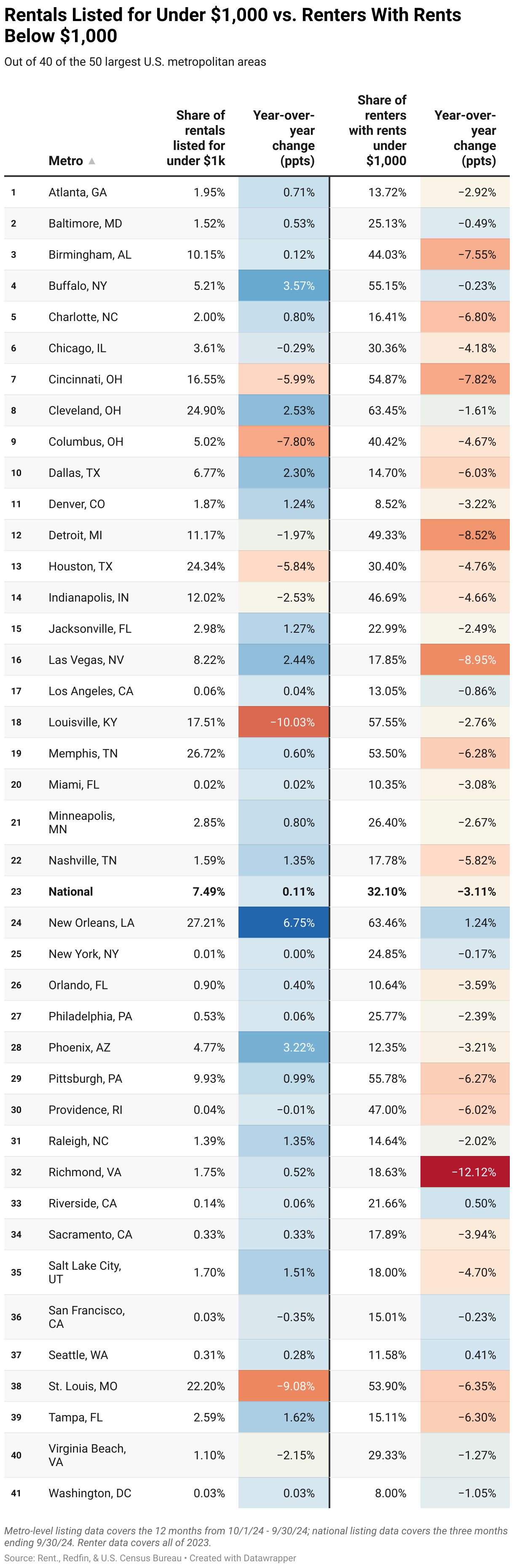

Around the country, there are 13 metros that have less than 1% of rentals listed for under $1,000, while 7 metros have fewer than 0.1%. The four metros with the lowest share of $1,000 rentals are New York (0.01%), Miami (0.02%), San Francisco (0.03%), and Washington, D.C. (0.03%). Median asking rents in these areas all top $2,000.

At the other end of the spectrum, five metros have over 20% of rentals listed for under $1,000: New Orleans (27.2%), Memphis (26.7%), Cleveland (24.9%), Houston (24.3%), and St. Louis (22.2%). These places are all among the most affordable for renters in the country, with median rents around $400 below the national average.

It’s worth noting that many of the most affordable metros have seen large rent increases lately – likely because low rents have fueled a rise in demand. The median asking rent in Cleveland, for example, rose 11.1% year over year in September – one of the largest jumps in the country. Louisville also saw a sizable increase.

When looking at the share of renters paying less than $1,000, New Orleans tops the charts at 63.5%, with Cleveland (63.5%) and Louisville (57.6%) close behind.

Two interesting metros are Phoenix and Las Vegas, which saw some of the largest year-over-year declines in the share of renters paying under $1,000. Phoenix dropped 15.7 ppts (28.1% to 12.4%), and Las Vegas fell 14.7 ppts (32.5% to 17.8%). Both cities surged in popularity during the pandemic, which drove up demand for housing and, in turn, rents.

$1,000 rentals: Complete metro-level data

Methodology

Based on a Redfin analysis of data from the U.S. Census Bureau, Redfin.com, and Rent.com.

The data on the share of rental housing by price point and length of stay comes from the U.S. Census Bureau’s 2012-2023 American Community Surveys (ACS*) for units in apartment buildings with five or more units. 2020 data is excluded due to pandemic-related data collection issues. This data has been inflation-adjusted and represents 2023 dollars.

The data on the share of rental listings by price point comes from Redfin and Rent. and covers units in apartment buildings with five or more units. This data, which is based on asking rents, has been inflation-adjusted to reflect values in September 2024 dollars.

*ACS data was retrieved from IPUMS USA:

Steven Ruggles, Sarah Flood, Matthew Sobek, Daniel Backman, Annie Chen, Grace Cooper, Stephanie Richards, Renae Rodgers, and Megan Schouweiler. IPUMS USA: Version 15.0 [dataset]. Minneapolis, MN: IPUMS, 2024. https://doi.org/10.18128/D010.V15.0