Top takeaways from December:

- The U.S. asking rent fell 0.1% year over year in January to $1,599.

- On a monthly basis, rents rose 0.5% ($5), up from $1,594 in January.

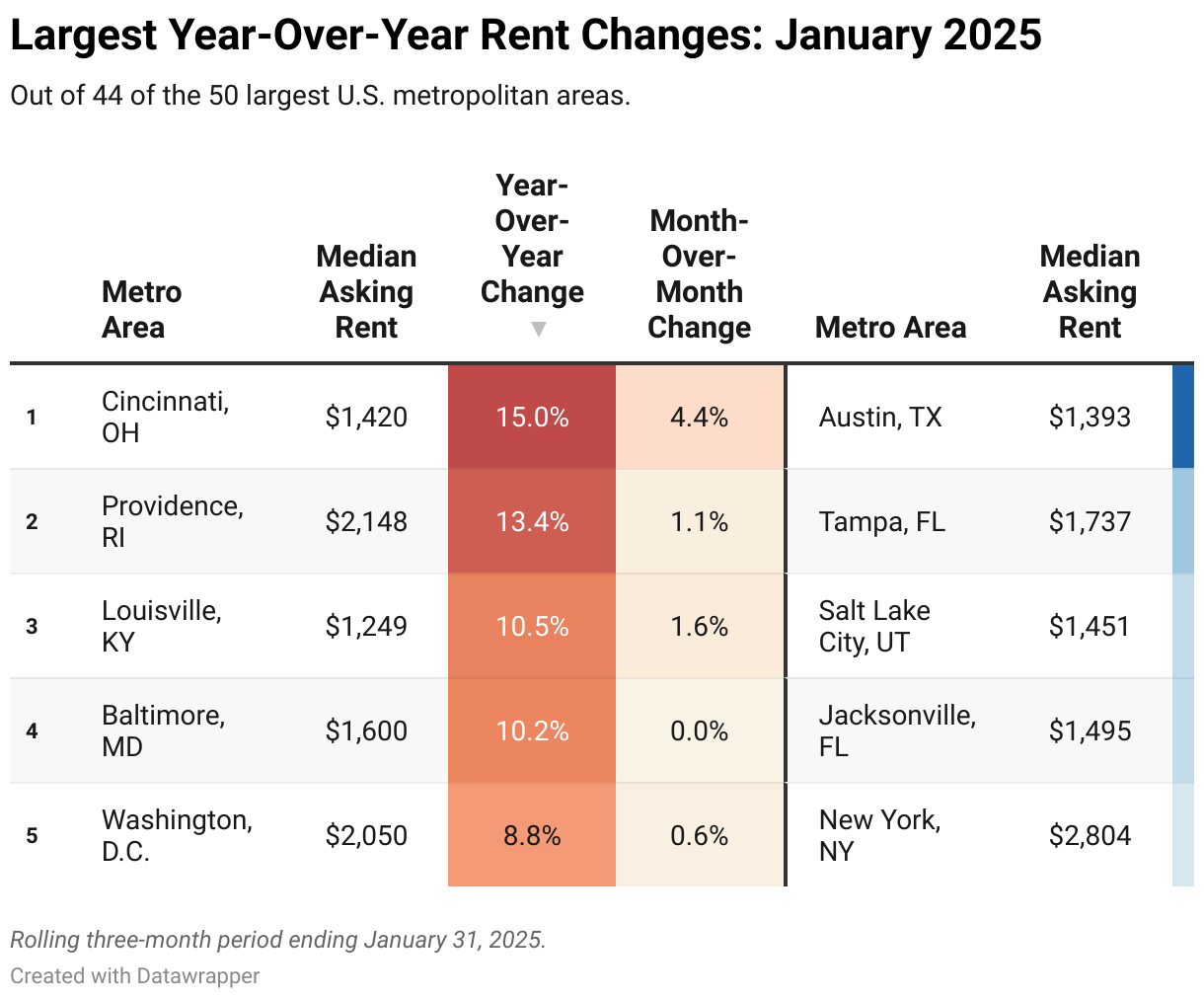

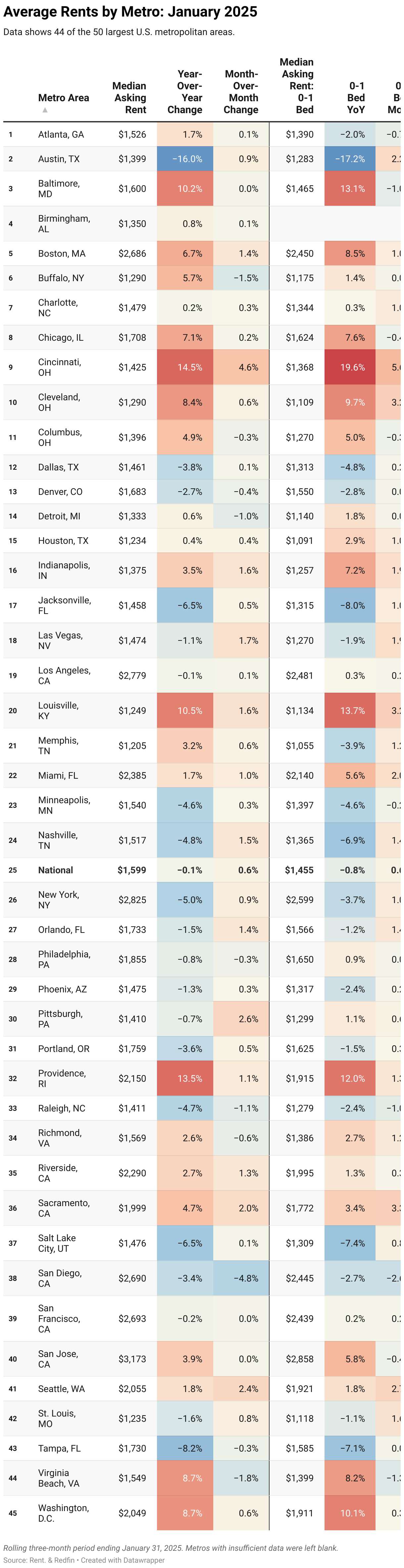

- Cincinnati, Providence, and Louisville saw the biggest rent increases; Austin, Tampa, and Salt Lake City posted the biggest declines.

- 2025 continues to be a renter’s market: Apartments are coming online at record levels, pushing rents down and widening the affordability gap between buying and renting.

Average U.S. rental trends

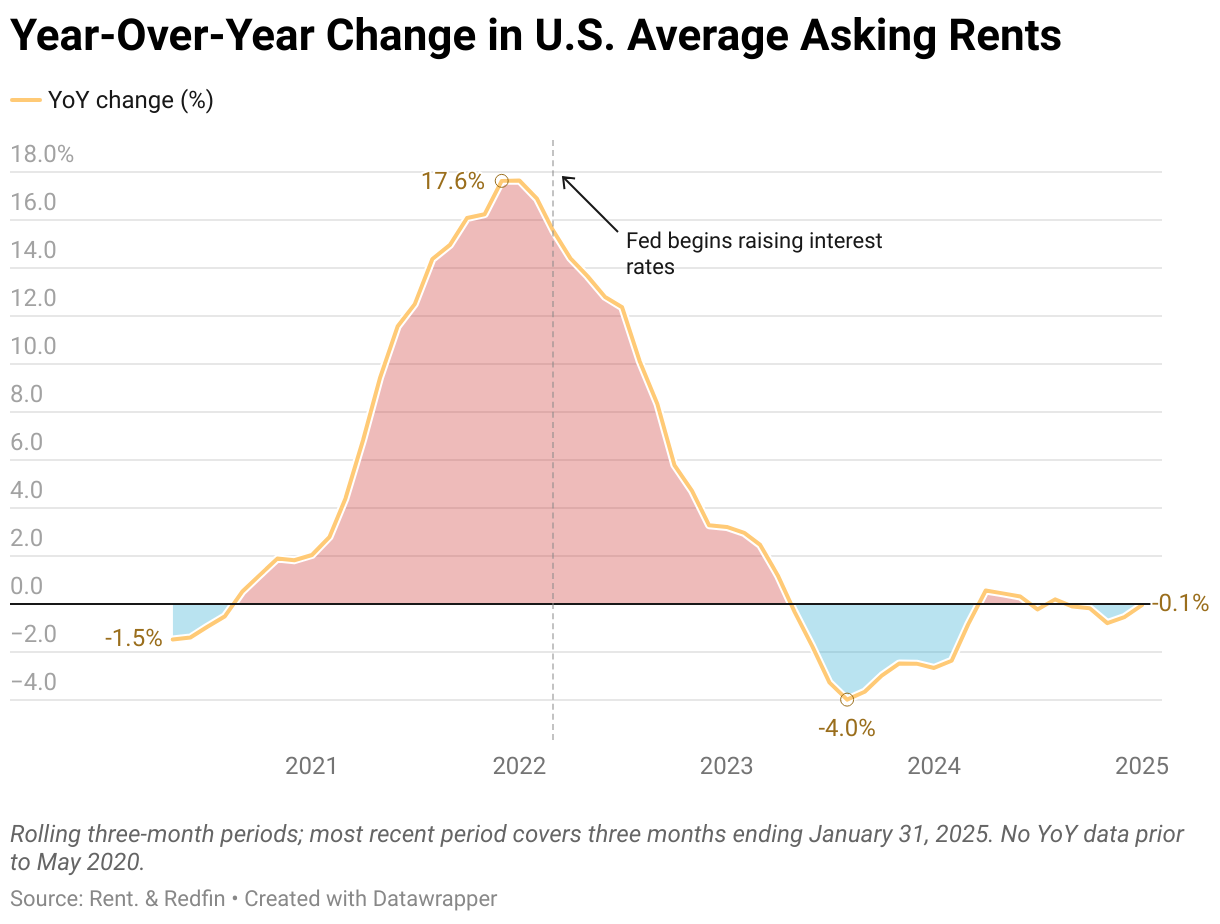

The average rent fell just 0.1% year over year in January to $1,599. On a monthly basis, rent prices rose by 0.5% ($5). The price per square foot of an apartment, which has hovered around $1.80 for over a year, fell 1.5% compared to January 2024.

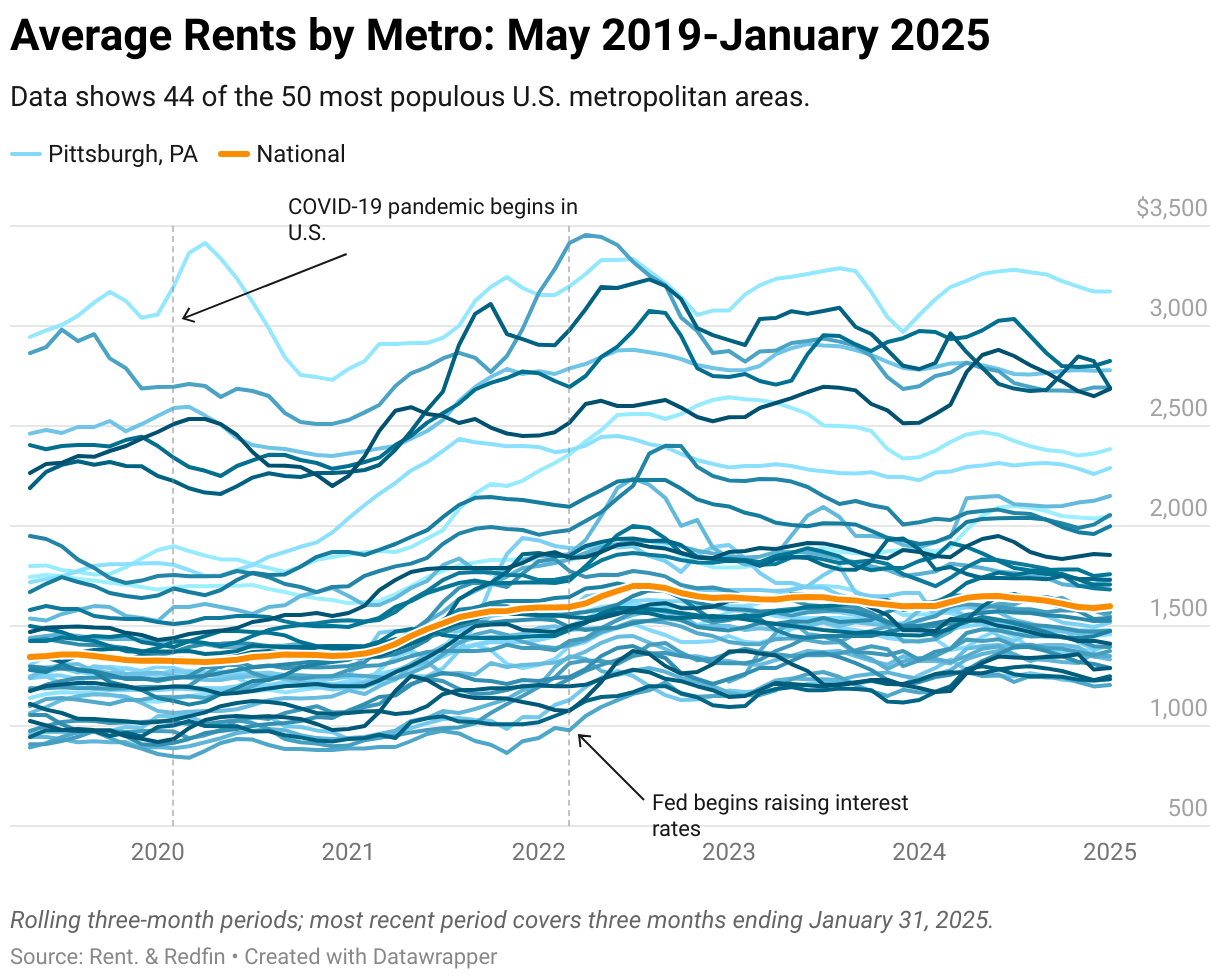

Rents have remained calm so far this year – a welcome respite for renters. Prices have held somewhat steady for over two years, following aggressive growth in 2021 and 2022. Rents are 6.2% below their record high of $1,700 set in August 2022.

However, these trends may be in the early stages of shifting. New apartment construction has dropped sharply since late 2024 – largely because so many units are still coming online – and may be further hampered by a range of new tariffs. Demand for rentals may also continue to grow as high mortgage rates push homeownership out of reach for more people. Rents may rise substantially if demand starts to outpace supply.

For now, though, rents are unlikely to post major year-over-year gains.

What today’s rent prices mean for renters

Renters can afford more space than they could a year ago because although rents haven’t changed much, incomes have gone up.

The wage needed to afford the typical apartment has dropped to $63,680 – the lowest level in nearly three years. Affordability continues to improve thanks to a surge of apartments hitting the market. More apartments means more supply, which helps offset demand and keep prices in check. Vacancy rates are also at three-year highs, and new apartments are cheaper than they’ve been in over two years. Plus, fewer renters are moving than ever, meaning renters may face less competition for a unit.

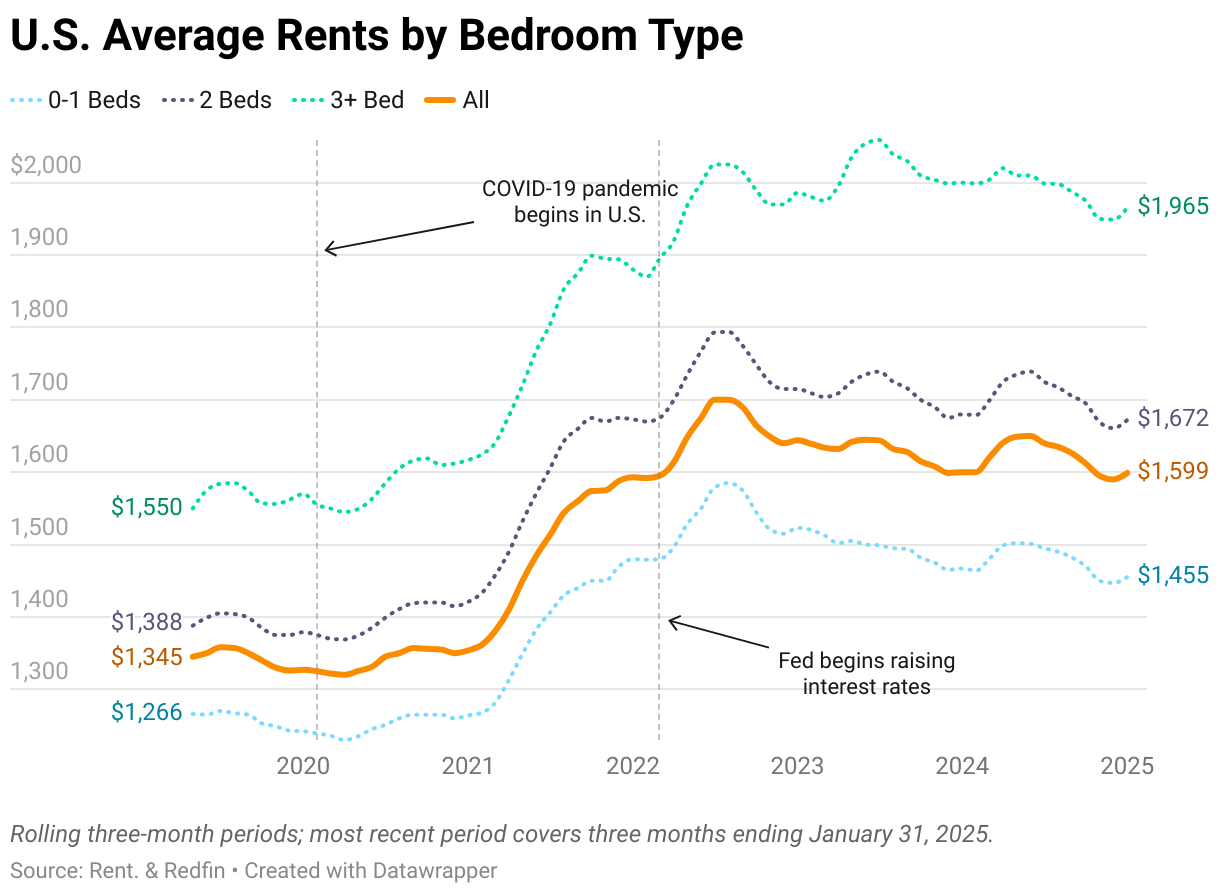

Rental trends by bedroom type

Rents fell across all bedroom types for the seventh consecutive month in January, highlighting how record levels of construction have improved affordability.

- Rents for 0-1-bedroom apartments fell 0.8% YoY to $1,455

- Rents for 2-bedroom apartments fell 0.5% YoY to $1,672

- Rents for 3+-bedroom apartments fell 1.8% YoY to $1,965

Metros with the biggest rent increases and decreases

Rents keep climbing in the Midwest

Many historically affordable Midwest and East Coast metros are seeing steady rent growth, primarily because they haven’t built as many new apartments. This supply/demand imbalance has helped drive rents higher. Cincinnati and Providence saw the largest rent increases in January.

Washington, D.C., which is unique because rents aren’t particularly affordable, but they’re still rising because construction hasn’t kept up with strong demand in recent years. Demand for lower-priced rentals is especially high.

Prices drop steeply in the Sun Belt

In many Sun Belt cities, new apartments continue hitting the market at a fast clip to meet skyrocketing demand, boosting supply and bringing down rents. This frenzy has prompted some property managers to offer rent concessions (free parking, free month of rent, etc) to attract tenants. Rents are falling quickest in Florida and Texas metros where this is most pronounced, like Tampa and Austin.

Austin once again topped the list of the largest rent decreases, continuing its steep decline from post-pandemic highs. Rents are 22.2% below their 2023 record of $1,799. As people leave in droves, apartment supply outweighs demand, with some saying the rental market is “collapsing.”

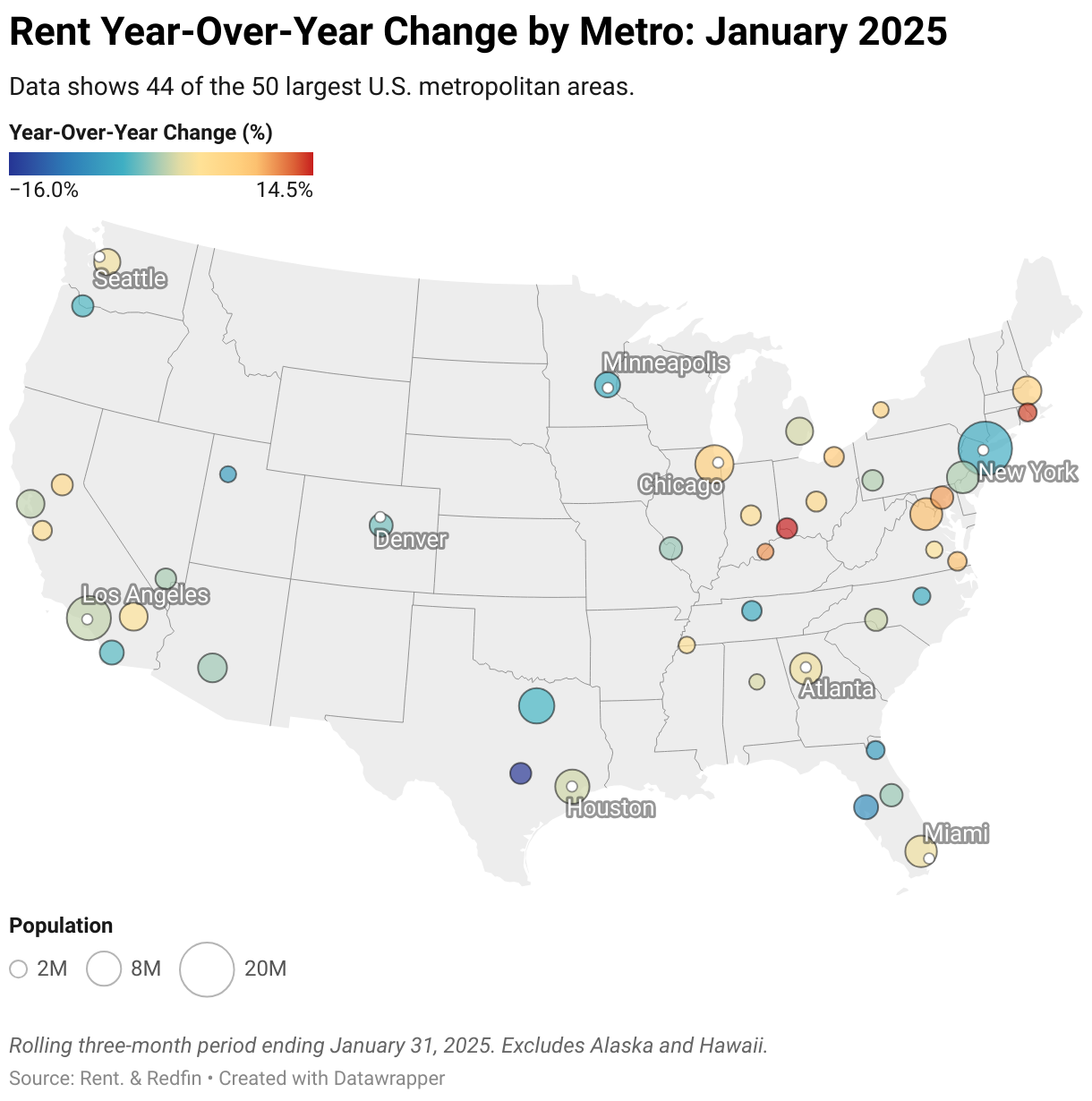

Year-over-year rent changes by metro

Historical change in rents by metro area

Rent prices have changed significantly since the pandemic, but some metros have seen much larger changes than others.

Rents in San Francisco, for example, have fallen nearly $800 from a record high of $3,455 in 2022 to $2,693 in January 2025. On the other end of the spectrum, the typical rent in Providence has climbed $650 in the past five years.

Complete metro-level data

Methodology

According to a Redfin analysis. Asking rent figures in this report cover newly listed units in buildings with five or more units. The median (what we call “average”) is calculated based on a rolling three-month period. For example, the median asking rent for January 2025 covers rentals that were listed on Rent. and Redfin from November 30, 2025 to January 31, 2025. Data on Rent. market trends pages may differ from data shown in this report.

Metro-level data in this report covers 44 of the 50 most populous U.S. core-based statistical areas (CBSAs). National figures are based on data for the entire U.S.

Asking rents reflect the current costs of new leases. In other words, the amount shown as the median asking rent is not the median of what all renters are paying, but the median asking price of apartments available for rent.