Top takeaways from this report:

- The U.S. median asking rent rose 0.6% year over year in September to $1,634

- However, rents actually fell 0.2% ($2) on a monthly basis, down from $1,636 in August

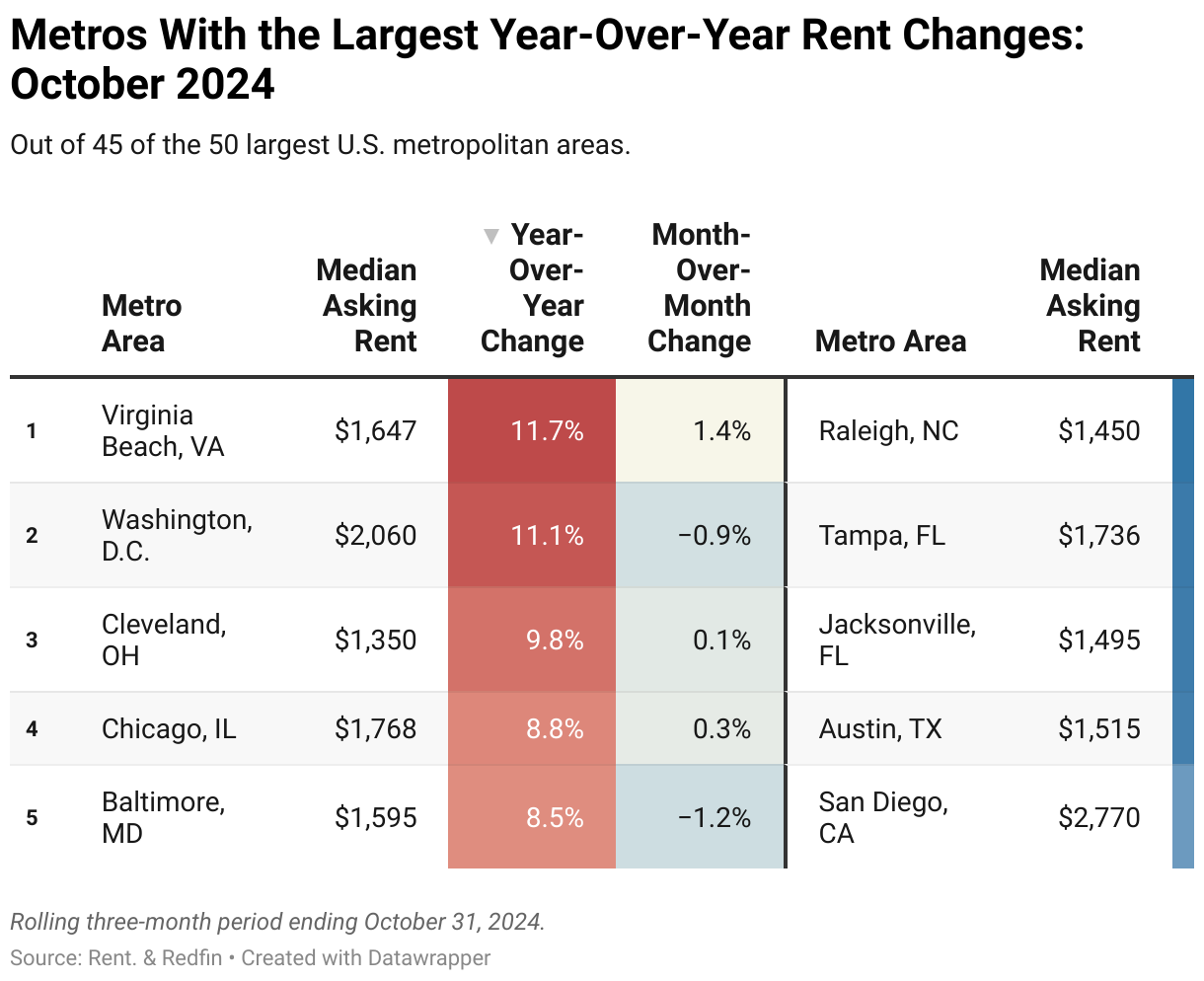

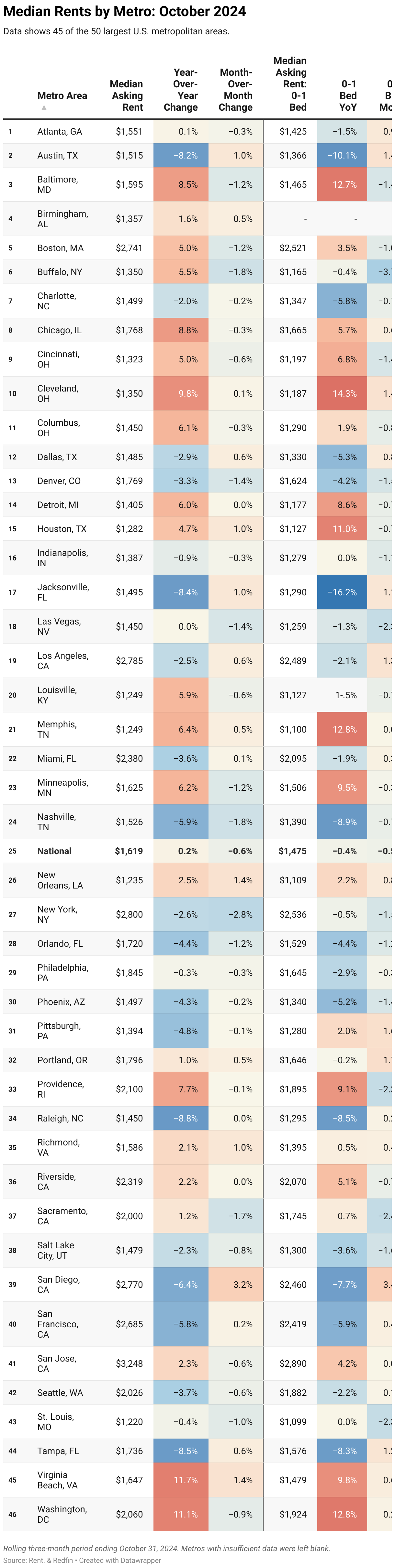

- Washington, D.C., Virginia Beach, and Cleveland saw the biggest increases; Jacksonville, Raleigh, and San Diego posted the biggest decreases

What’s happening with rents nationwide?

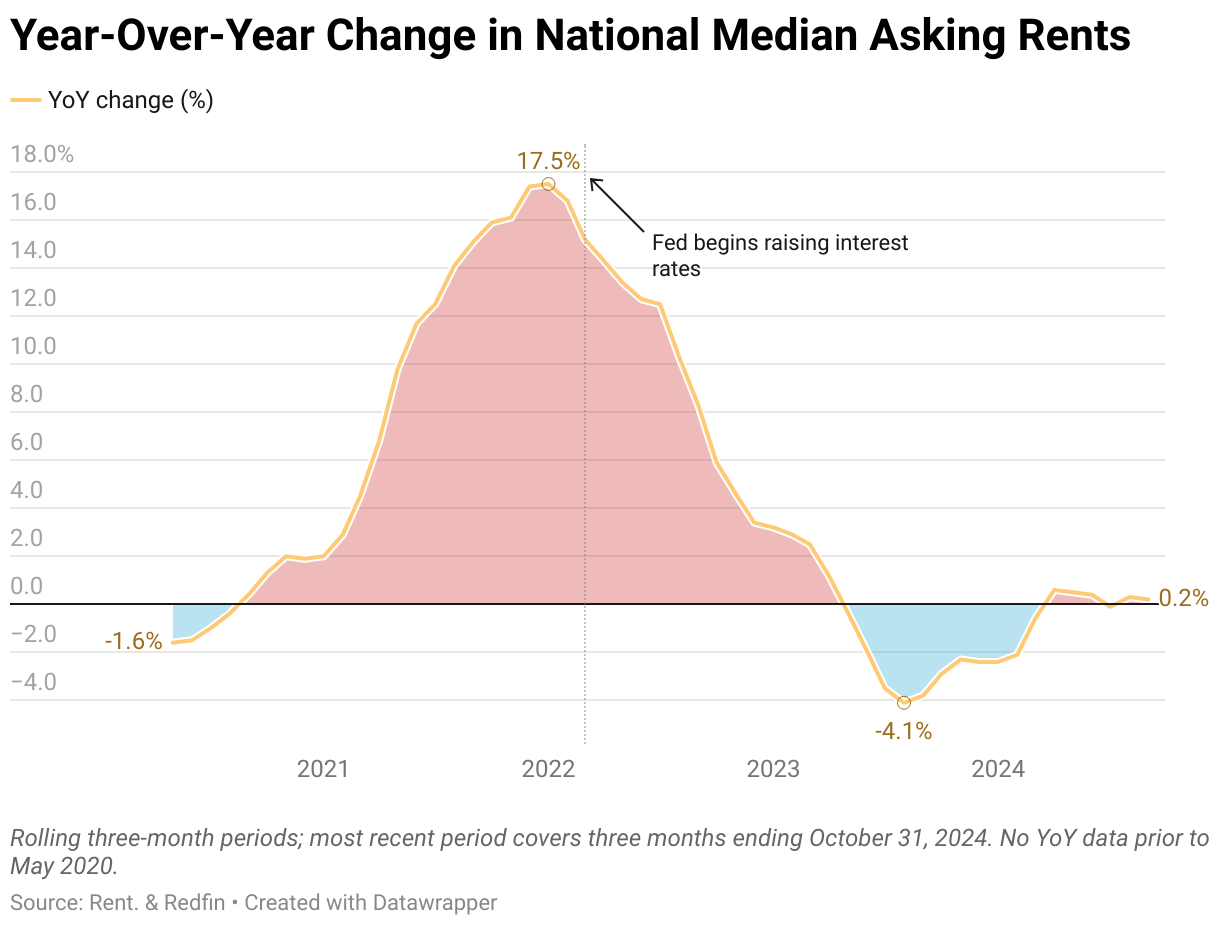

The median U.S. asking rent rose 0.6% year over year in September to $1,634. This is the sixth consecutive increase following 11 months of decreases.

In general, rents have held steady for the past year and a half since they hit their record high of $1,700 in August 2022. And on a monthly basis, rents actually fell by 0.2% ($2) compared to August.

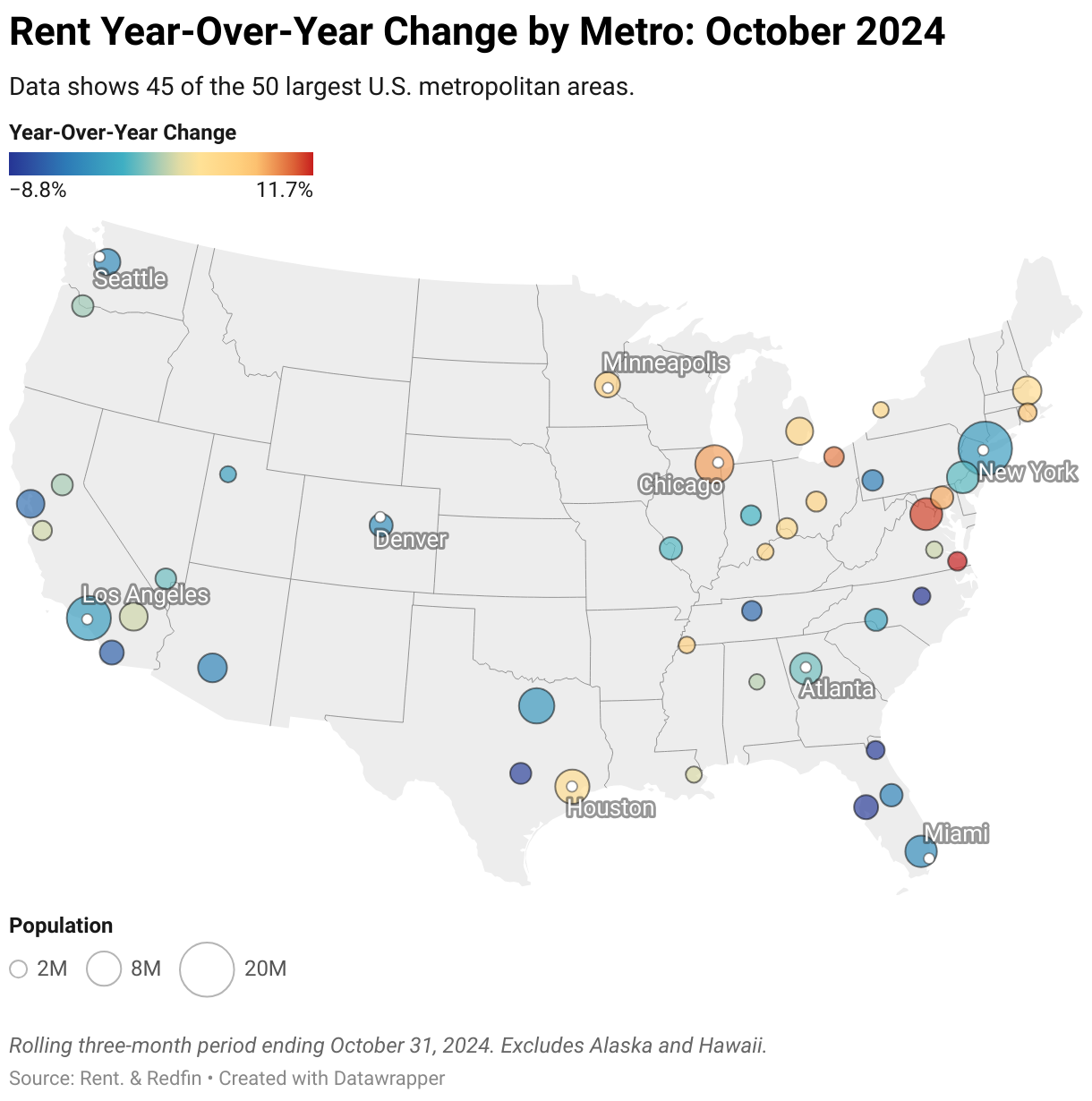

Rents are holding steady nationally but could look very different depending on where you are in the country. In some areas, especially in the Sun Belt states, multifamily building completions have been at historic highs, and some metros now have too much supply. This has prompted an uptick in rent concessions from some property managers to attract prospective tenants.

In other areas, where construction has been more limited, rents are rising. Demand from young renters and a fast-growing renter population are also contributing factors.

Rental breakout by bedroom type

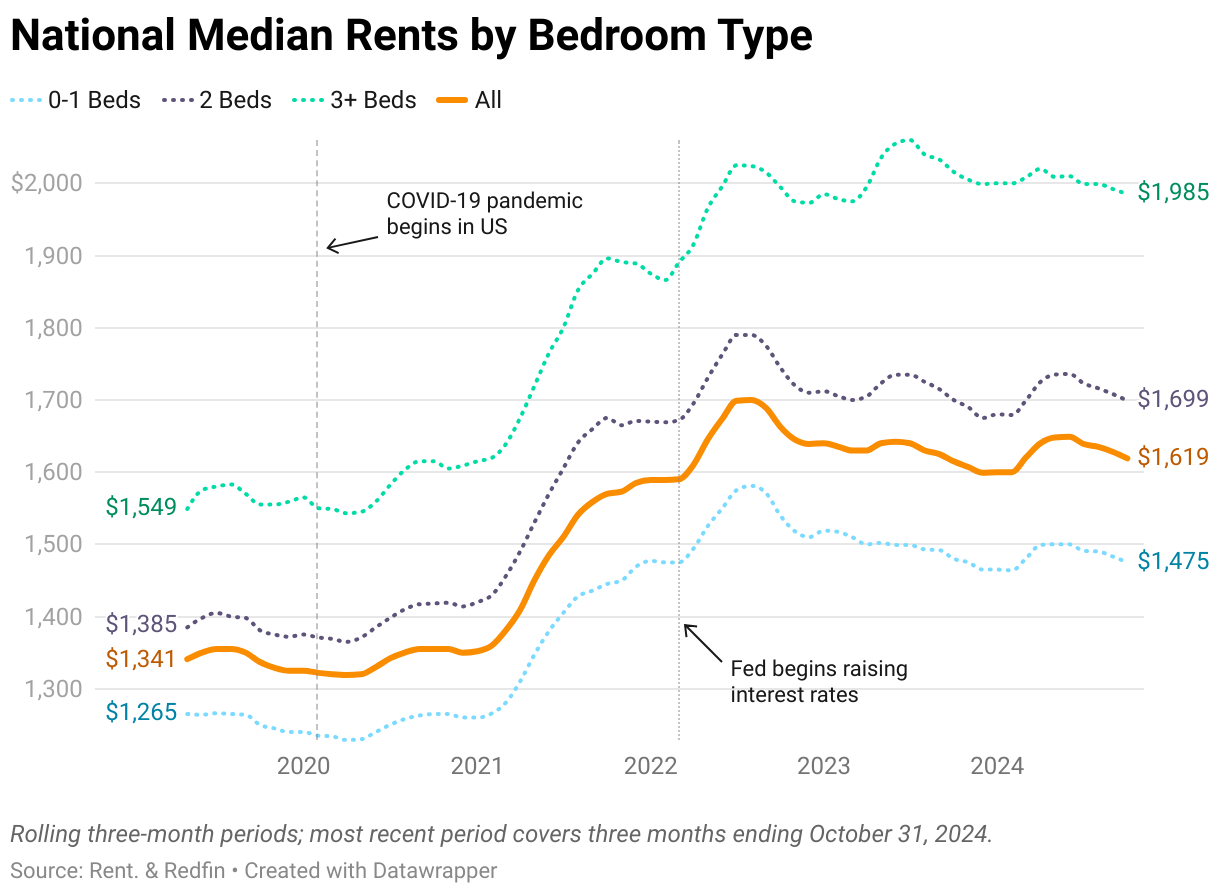

When looking at all bedroom types combined, rents rose slightly year over year. However, when isolating by bedroom type, rents actually fell for the second month in a row:

- Rents for 0-1-bedroom apartments fell 0.4% YoY to $1,486

- Rents for 2-bedroom apartments fell 0.2% to $1,711

- Rents for 3+-bedroom apartments fell 1.9% YoY to $1,995

It may seem odd that rents rose when looking at all bedroom types combined but fell when isolating by bedroom type. This is due to the statistical phenomenon known as Simpson’s paradox, where trends that appear in groups of data may disappear or reverse when looking at the data as a whole.

U.S. metros where rents are rising and falling

Why are rents rising in these metros?

Several historically affordable Midwest and East Coast metros have experienced months of steady rent growth, primarily due to limited new apartment construction. This supply-demand imbalance has helped drive rents higher.

Washington, D.C. is unique because rents aren’t particularly affordable, but they’re still rising because construction hasn’t kept up with strong demand in recent years.

Why are rents falling in these metros?

Rents are falling in several Sun Belt metros, which built the most apartments since the pandemic in an effort to meet booming demand. Now, they’re faced with an abundance of supply, a rise in unfilled apartments, and a drop in new construction.

This trend has been most obvious in Austin, which experienced a wave of migration during the pandemic and ramped up construction to meet demand. Now, apartment supply outweighs demand. Austin also led the nation in year-over-year rent drops from June to August this year.

Year-over-year change by metro

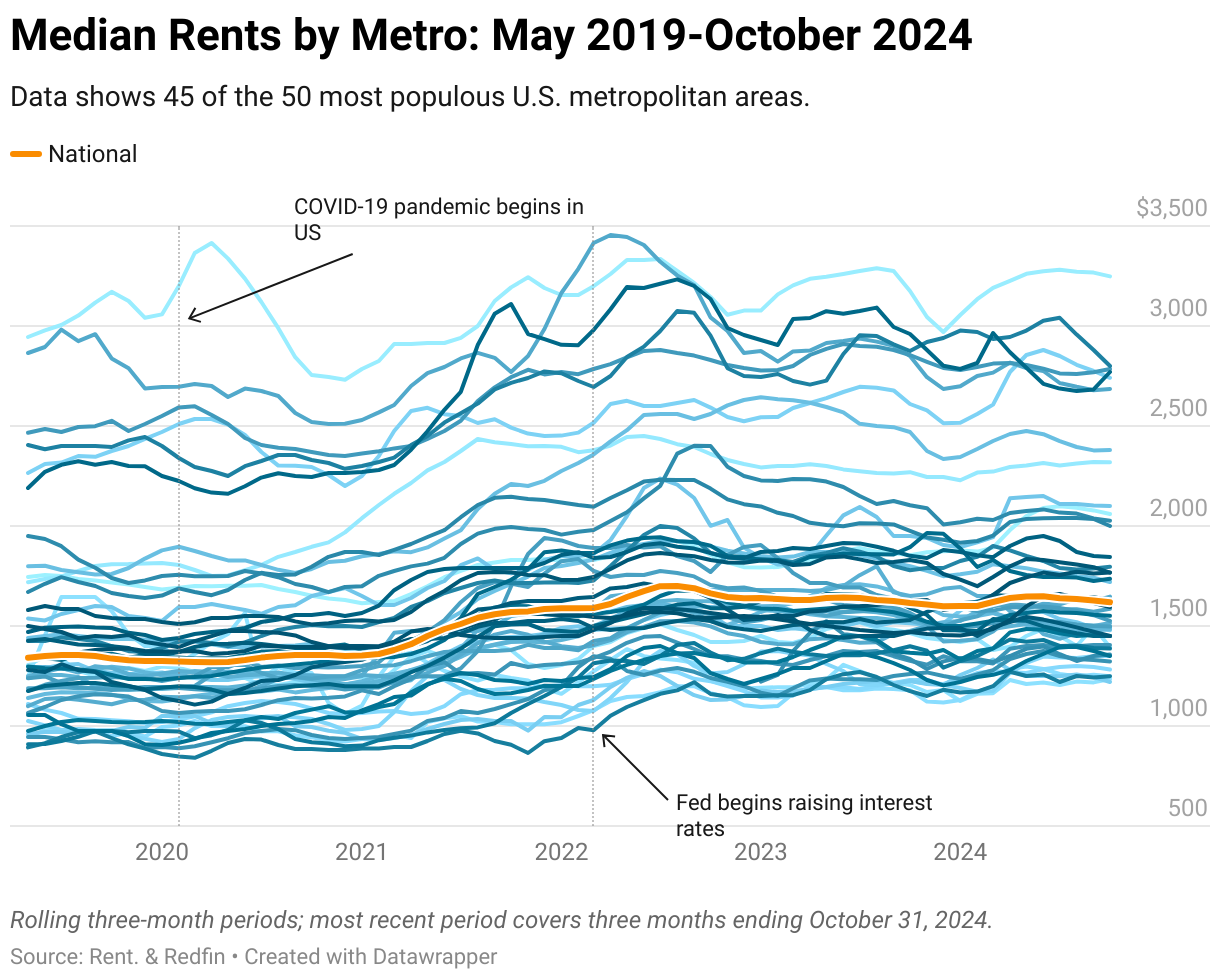

Historical change in median rents by metro area

Rents have changed significantly since the pandemic, but some metros have seen much larger fluctuations than others.

San Francisco, for example, has fallen nearly $800 from a record high of $3,455 in 2022 to $2,683 in September 2024. On the other end of the spectrum, Nashville rose almost $700 from $1,288 to $1,940 in just five months in 2022, before leveling out at $1,561 in September 2024.

September 2024: Complete median metro-level data

Methodology

According to a Redfin analysis. Asking rent figures in this report cover newly listed units in buildings with five or more units. The median is calculated based on a rolling three-month period. For example, the median asking rent for September 2024 covers rentals that were listed on Rent. and Redfin during the three months ending September 30, 2024. Data on Rent. market trends pages may differ from data shown in this report.

Metro-level data in this report covers 45 of the 50 most populous U.S. core-based statistical areas (CBSAs). National figures are based on data for the entire U.S.

Asking rents reflect the current costs of new leases. In other words, the amount shown as the median asking rent is not the median of what all renters are paying, but the median asking price of apartments available for rent.